us exit tax for dual citizens

When it comes time to expatriate from the United States one of the main. There is however an Expatriate Tax exception that covers many dual citizens including almost all so-called Accidental Americans those people who have a right to.

Expatriation Critical Financial Planning And Tax Considerations For U S Citizens And Green Card Holders

RENOUNCING US CITIZENSHIP AND THE DUAL CITIZEN EXCEPTION TO THE EXIT TAX.

. The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. All the US tax information you need every week Named by Forbes Top 100 Must-Follow Tax Twitter Accounts VLJeker. Would NOT be entitled to the dual citizen exemption to the Exit Tax.

Of course you can give up your US. 877A Exit Tax relies on the citizenship laws of other nations. The focus of this discussion will be on being born both.

Citizens who have renounced their. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria. Unfortunately it is a misconception that one can do away with ones US nationality without having filed tax returns in the US.

However US citizens are automatically liable to expat laws surrounding taxation and as a result are subject to exit tax rules. It is calculated in the same way as for expatriates who. How is exit tax calculated.

The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years. The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed. In some cases those laws of other nations are.

Nonresident Alien Income Tax Return if you are a dual-status taxpayer who gives up residence in the United States during the year and who is not a US. 877A Exit Tax rules in the. I renounced my US citizenship on April 28th of this year at the US consulate in Montreal.

Would NOT be entitled to the dual citizen exemption to the Exit Tax. Exit tax is calculated. Tax person may have become a US.

The US has enacted an Exit Tax that prevents US citizens and green card holders from giving up their residency in order to avoid paying US taxes on accumulated wealth. IRC 877 Dual-Citizen Exception Substantial Contacts. Generally if you have a net worth in excess of 2 million the exit tax will apply to you.

Section 101 a 22 of the Immigration and Nationality Act INA states that the term national of the United States means A a citizen of the United States or B a person. As you will see by renouncing Canadian citizenship Mr. IRC 877 Dual-Citizen Exception Substantial Contacts.

At the time of writing the current maximum. You must file Form 1040-NR US. The exit tax in the US is a tax that may apply to US citizens or long-term residents who terminate their US citizenship or residency if they are considered covered expatriates.

In addition to the exit tax it should be noted that Section 2801 of the US. Section 101 a 22. The post demonstrates how the dual citizen from birth exemption to the S.

Named by Bloomberg Tax Professionals to Follow on. Cruz surrendered is right to avoid the United States S.

How To Germany Dual Citizenship Germany Usa

Green Card Exit Tax Abandonment After 8 Years

Due Passaporti Two Passport Travel Dual U S Italian Citizenship

Dual Citizen Needing Us Tax Help Here S A Guide

Exit Tax In The Us Everything You Need To Know If You Re Moving

How To Expatriate From The United States New 2022

Myths About Giving Up American Citizenship

What Are The Benefits Of Dual Citizenship In 2022

Americans Living In Europe Renouncing Citizenship Americans Overseas

Should You Renounce Your U S Citizenship For Tax Reasons

The Complete Guide To Dual Citizenship For American Citizens The Points Guy

How To Expatriate From The United States Escape Artist

Us Citizenship Renunciation What You Need To Know Online Taxman

Us Citizenship Renunciation What You Need To Know Online Taxman

Timing Considerations For Expatriation Tax Compliance And Form 8854

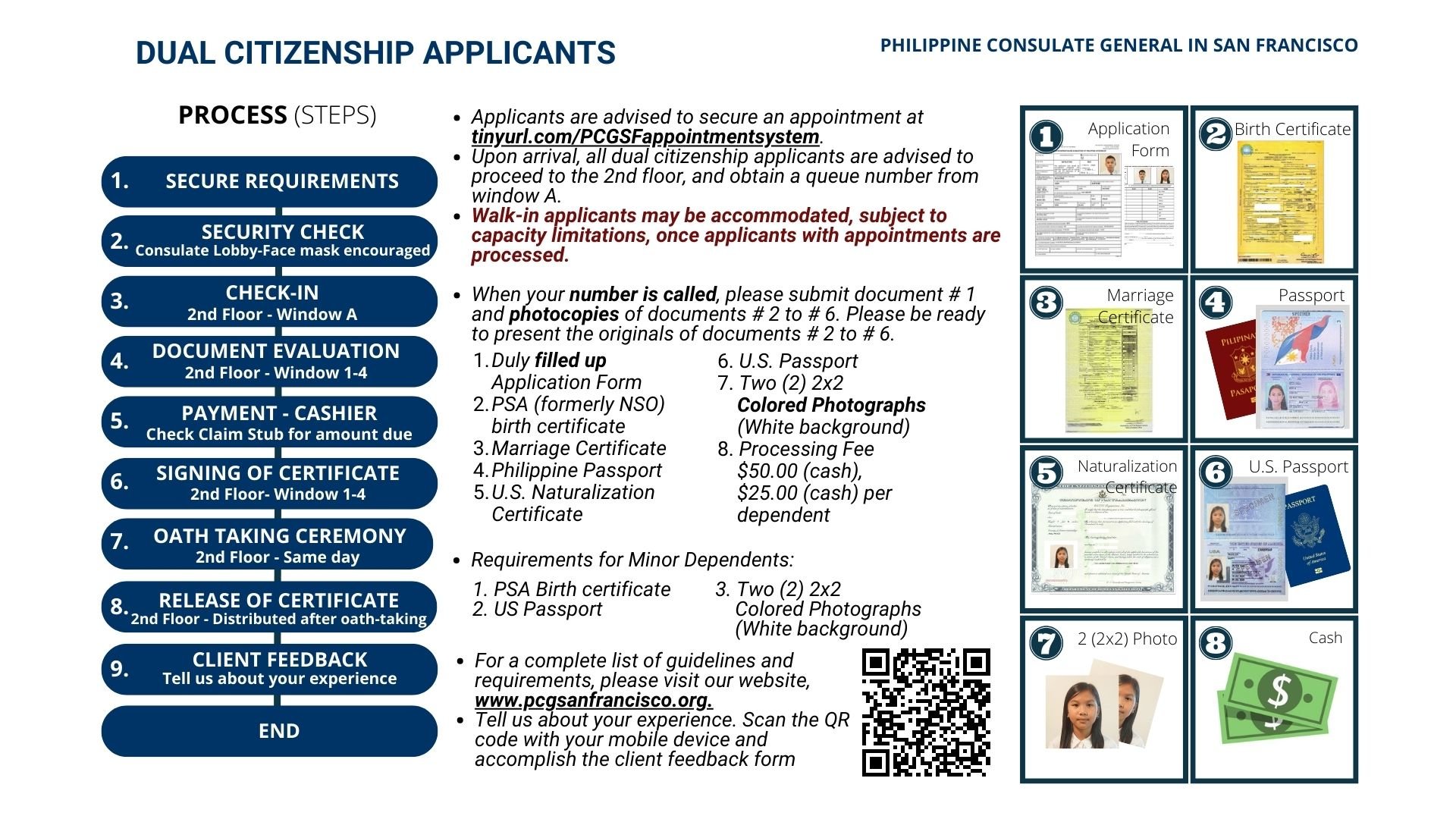

Dual Citizenship Philippine Consulate General In San Francisco

Tax Consequences Of Expatriation Palisades Hudson Financial Group

Americans Abroad Renounce Citizenship To Escape Tax Law S Clutches Wealth Management